Having a low budget is the worst way to plan big goals. Planning to increase your budget should be the first goal that you set. The best way for you to keep track of your money is by setting a goal. This can either be a goal for how much you plan to spend on a purchase or how much money you want to save. The same rules apply to both. Typically, when most people set a budget, they have a specific financial goal in mind. By doing this, reaching big goals on a small budget will be a bit more foolproof.

These could include paying down debt, planning a vacation, or starting a business. Your goals do not have to be that extreme. Simply saving up to pay off a simple credit card or layaway bill, will be good enough to get you started.

Using A Low Budget To Set Your Goals

Once you have your specific goal in mind, the next few steps toward reaching your goal will be that much simpler. Answer these six questions to get you started. Be sure to keep reminders of your goal everywhere. This can be done by creating a savings calendar.

- What is your goal?

- How much will it cost to reach the goal?

- When do you hope to reach the goal?

- How much do you need to save per month to reach your goal?

- How much do you have available now?

- What can you cut to acquire that money?

Budgeting is a great way to save money and reach your financial goals. It involves tracking your income and expenses so that you can make sure you are spending less money than you earn. Budgeting can also help you to identify areas where you can cut back on spending so that you can save more money. There are many different budgeting techniques, but some of the most common include:

- The 50/30/20 budget: This budget allocates 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- The zero-sum budget: This budget allocates every dollar of your income to a specific expense or savings goal.

- The envelope system: This budget involves setting up individual envelopes for each of your expense categories. You then fill each envelope with cash at the beginning of the month and can only spend the money in that envelope on that expense category.

No matter what budgeting method you choose, the most important thing is to be consistent. Review your budget regularly and make adjustments as needed. Below are tips for budgeting to save money and reach your financial goals:

- Set financial goals. What do you hope to achieve with your money? Do you want to save for a down payment on a house? Pay off debt? Retire early? Once you know what your goals are, you can start to create a budget that will help you reach them.

- Track your income and expenses. This is the first step to creating a budget. You need to know where your money is coming from and where it is going. You can track your income and expenses using a spreadsheet, or budgeting app, or simply write them down in a notebook.

- Set a budget. Once you have tracked your income and expenses, you can start to set a budget. Decide how much money you want to allocate to each expense category.

- Review your budget regularly. Your financial situation can change over time, so it is important to review your budget regularly and make adjustments as needed.

- Cut back on unnecessary expenses. Take a close look at your budget and identify areas where you can cut back on spending. Do you really need to eat out every week? Do you have subscriptions that you are not using?

- Automate your savings. Set up a recurring transfer from your checking account to your savings account each month. This will help you to save money without even having to think about it.

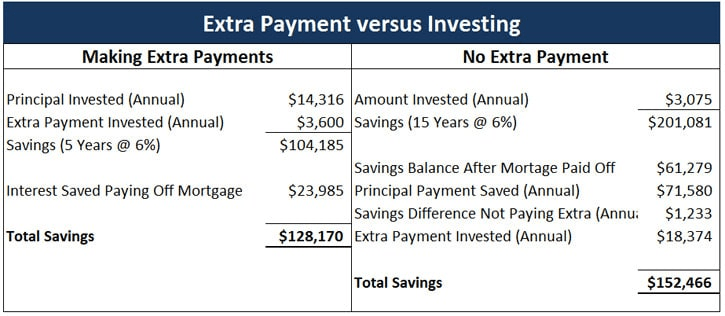

- Make extra payments on debt. If you have debt, try to make extra payments each month. This will help you to pay off your debt faster and save money on interest.

Budgeting and saving money can be challenging, but it is worth it in the long run. By following these tips, you can reach your financial goals and build a secure financial future.