The snowball method is a financial trick that will help you make debt payments as quickly as possible. This is a debt-reduction strategy that can be applied to revolving credit or loans.

What is the snowball method?

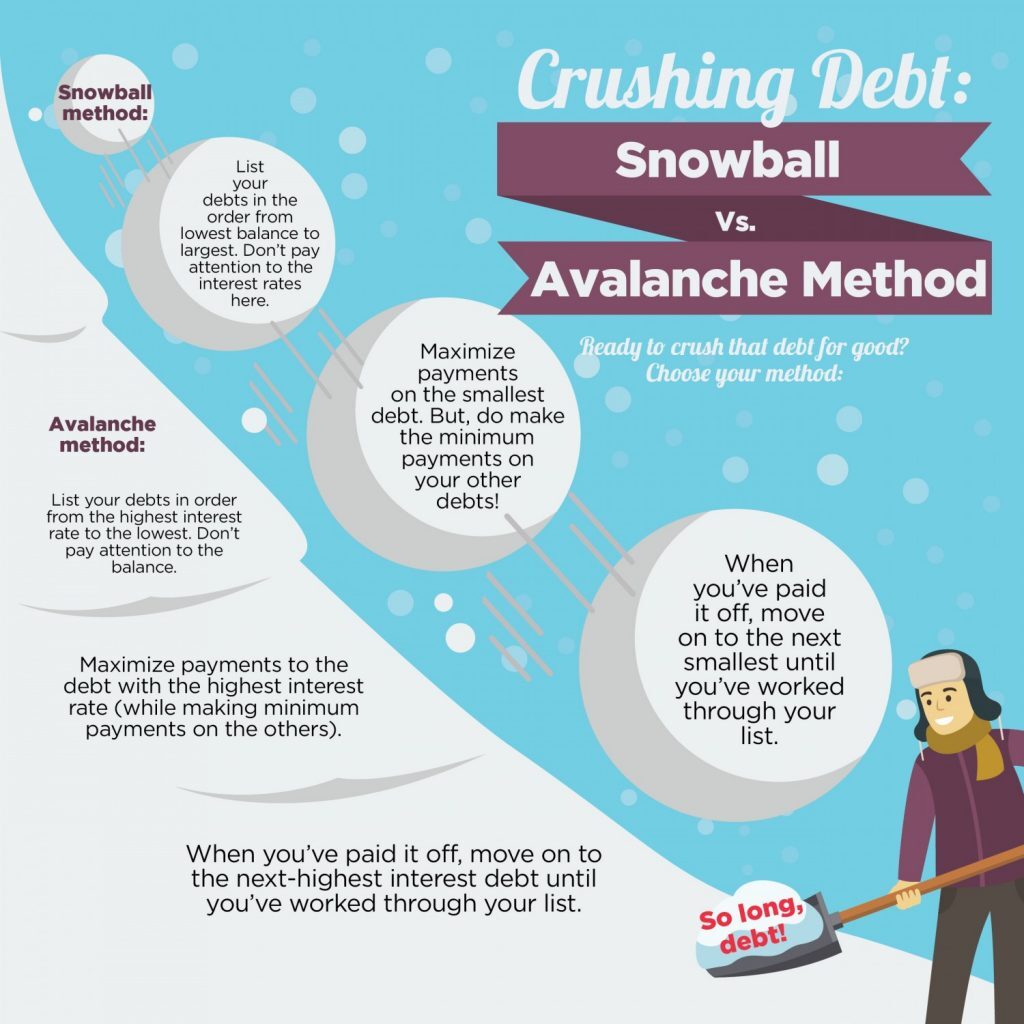

Using finance jargon This method is supposedly a do-it-yourself strategy to reduce debt. This particular method focuses on paying down your smallest debt balances before moving on to larger ones. It is based on the idea of gaining momentum with each debt that is paid off. This method was initially populated by Dave Ramsey, a well-known personal finance expert. The main focus would be on your smallest balances first, while making minimum debt payments on all other bills. This “snowball” method is known for creating an empowering feeling of progress. This can be a motivating factor when tackling debt repayment.

Once you complete the balance payout, take those previously allocated funds and use them towards the next inexpensive balance. Thus the snowballing of payments. (Head, stomach, and body) used to pay off debts. Repeat this cycle until your debt is paid off. This process may not save you money, depending on how much debt you owe. The snowballing of payments involves making the minimum payments on all your debts and then taking the money you would have spent on other debts and putting it towards one debt at a time. This will allow you to use debt-paying finances to pay your debt. If that makes any cents.

Imagine a snowball at the top of a hill. As you begin to roll the snowball, you gather more momentum. Continue adding the minimum payment for each paid-off bill to the next one until all your debt is repaid. This is perfect for student loan debt payments.

How is the snowball method used?

- The snowball method is an easy place to start, as you may already be paying all these bills as a whole anyway.

Create a list of all your debts.

- Write down every penny you owe. This may be very painful for some and enlightening for others. Go through all your bills and list their totals. Using your current credit report will be extremely helpful.

- Don’t forget that your daily expenses and subscriptions won’t be included. These just list credit cards, loans, and collection accounts.

- First, be sure that you’ve budgeted enough to cover the minimum monthly payment for every debt. Now, arrange the debts by balance, from smallest to largest. disregard the interest rate on each.

Sort bills by size, from smallest to largest.

- This may not make sense, but it will help you determine the order in which these bills should begin to be fully paid off.

Pay off the smallest bill first.

- This will be the bill with the lowest balance. Let’s say you have a credit card with a balance of $50 and a $25 minimum payment. You would make the last two minimum payments or, if possible, pay off the entire $50 balance. This would eliminate that entire bill.

Use the payment for the paid-off bill for the next payment.

- After one bill is paid off completely, use that money to pay your other bill payments. Using the above example, let’s say you pay off the entire $50 balance. This would free up $25 a month from not having to make that monthly payment. You would use that monthly payment to add extra payments to your existing bills.

- Let’s say your second smallest bill has a $100 balance with a monthly payment of $25. You already paid off one of your bills and saved $25 a month. You would normally make a $25.00 payment on this bill. This month, you can make a $50 payment. Using the money you saved, you can pay this bill off in two payments instead of four monthly payments of $25.00.

Continue using the monthly savings to pay off the rest of your debt.

- Use the money saved to add extra funds to your already designated monthly payment. If you save $50 a month by paying off two bills, you can add that whole payment to one bill, or you can split it up and add some of that money toward your other debt payments. Whatever payment option you choose, the extra money you are now able to save should be used to pay off the rest of your debts. If you complete the snowball effect, you will be on your way to paying off your debts in record time.