Today’s responsible adults who reach financial security were raised by financially savvy parents. They took the time to explain to their kids the measures it would take to reach financial freedom. This could have been successfully accomplished by teaching their children the value of money and the benefits of having a budget-conscious mindset.

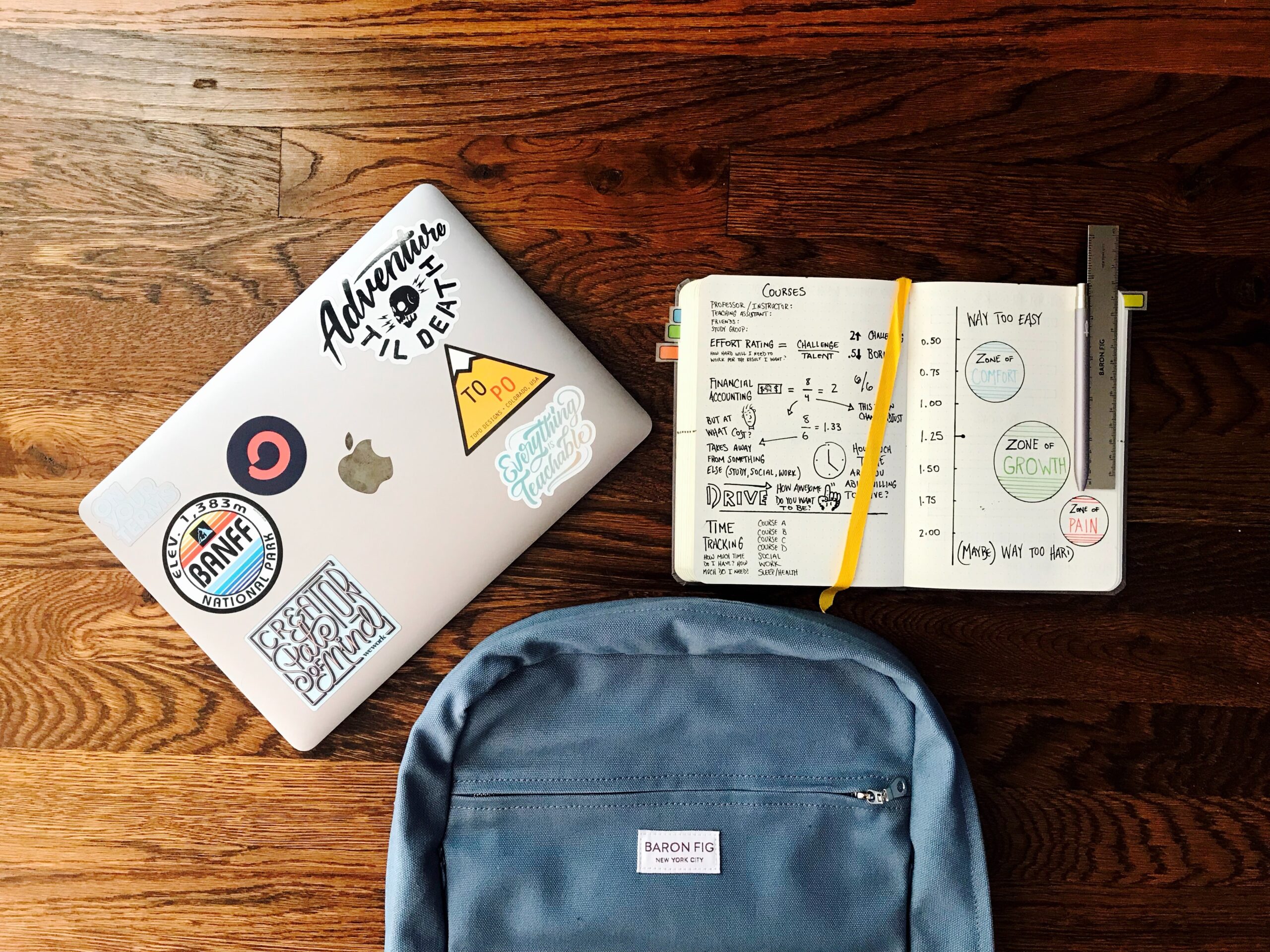

Financial Planning

They might have secretly saved money for their kids when they were young. This was done in the hopes that they would make wise financial decisions as adults. They would know how to manage their money and reach financial security. This may seem like it would be simpler to state than to do. Although I agree with that statement, it is possible. Just a little bit of time and effort would be required. You also need a strategy that will enable you to achieve your desired financial goals.

Teach them the value of money.

When you start to create your monthly budget, talk to your children. When you start to track and plan your monthly budget, sit down and do this with them. Calculating your monthly expenses will help you start the list. List all of your fixed expenses in writing. You have monthly obligations to pay these bills. Unless otherwise specified by the bill collector, these amounts never change. These include obligations like rent, auto loans, and insurance premiums.

Once you’ve determined those figures, see how much you can save by paying only 50% or 75% of other bills that change from month to month. This can include payments for your cell phone, utilities, cable, and food. Smaller fees will be charged for these fixed costs.

How do you involve your kids in this process?

You can ask some questions as to the kinds of foods the kids would prefer to eat throughout the month. Whether they desire fewer previously purchased snacks or brand-new snacks. Would they prefer to eat school lunches over those they packed themselves? Perhaps they would prefer home-cooked meals to takeout dinners. Instead of purchasing new toys, they might prefer to visit the park or the theater more. By spending more time outside you would be able to reduce your electric bill. You could use the money you would have saved on your electric bill to pay for those events.

This would help you reach your financial goals. It will also give you the opportunity to pay for school expenses. This can include school trips, school supplies, clothes, and shoes. This would also be able to financially supply them with funds for extracurricular activities. This includes tutor fees and school programs. You can also plan for upcoming holidays, vacation plans, and family outings. If they need new clothes or school supplies, you can factor those items into your budget or subtract the amount from your leftover funds before calculating how much money is already left to spend. That way If you go over your budget, you already planned it subconsciously.

Give them ways to earn money.

You can also inform your children of any increases or decreases in their allowance at this time. This would be if they already receive one for doing well in school or finishing chores. Give your kids a prepaid debit card if they’re old enough to handle their own money. If it’s not their own account, you can make them an authorized user on one of the ones you already control. They can choose the kinds of events they want to attend, use the money allotted for those events, or put it aside for something else.

Let them use their own money to buy things they need

A good way to teach them about wise spending is by getting them a piggy bank. The simplest way to teach your child to save money is by doing this. You can give them permission to use it during the week to pay for their own school supplies or if they are traveling to an important event. To double their piggy bank balance, you can promise to match the money they save at the end of the month. They will be more inclined to want to save their money rather than spend it all at once as a result.

Give them a calendar so they can mark their important dates on it. They can use this to determine when they should be saving money and when they can increase their spending while staying within their budget.

One thought on “How To Raise Financially Literate Children In 2023”